Hey there, future tech investors! Michael West here, absolutely thrilled to take you through the fascinating world of Micron Technology (MU) stock. As someone who’s passionate about connecting investors with knowledge that empowers decision-making, I can’t wait to help you understand what’s happening with this memory chip powerhouse.

Understanding Micron’s Position in the Tech Landscape

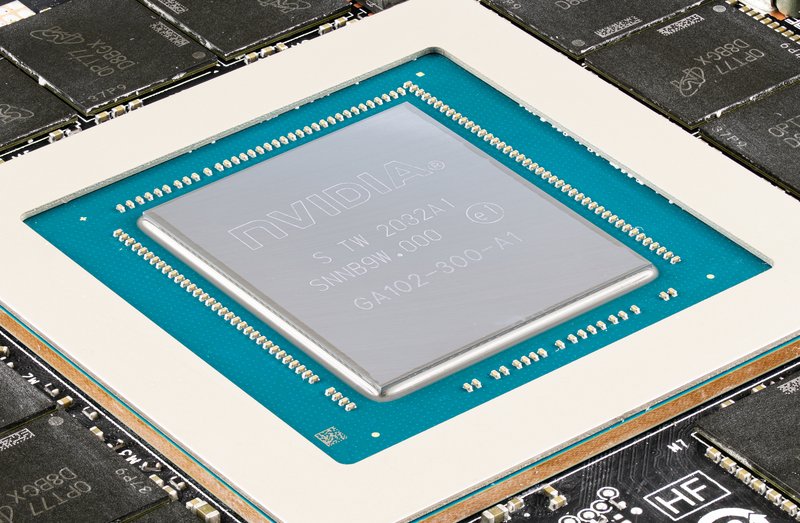

Micron Technology has established itself as a critical player in the memory chip market, and I’m genuinely excited about how they’re positioning themselves in the AI revolution. Based on recent analyst opinions, Micron is riding the wave of increasing demand driven specifically by AI data centers and enhanced computing needs. This isn’t just incremental growth we’re talking about—it’s potentially transformative!

When we look at the consensus from market experts, there’s a distinctly positive sentiment surrounding Micron, with many considering it undervalued at current levels. The 12-month price target of $128.70 represents significant upside potential from recent trading levels around $94.18.

But here’s where it gets really interesting: Micron operates in a highly cyclical industry. This cyclicality is something every potential investor needs to understand before jumping in.

Micron – The Cyclical Nature of Memory Chips

One analyst put it perfectly when they said, “MU is a trade, not an investment.” This statement captures the fundamental reality of memory chip manufacturers. Let me explain why this distinction matters so much:

-

Demand Fluctuations: Memory chip demand rises and falls based on broader tech adoption cycles, consumer electronics refreshes, and enterprise upgrade patterns.

-

Pricing Volatility: When demand outstrips supply, prices soar. When supply exceeds demand, prices crash. These swings can be dramatic and occur relatively quickly.

-

Long Periods of Underperformance: As several analysts noted, when memory chip companies fall out of favor, that period can last for quite some time—anywhere from 2-6 quarters or even longer.

-

Manufacturing Capacity Challenges: Building new chip fabrication facilities is incredibly expensive and time-consuming, making it difficult to rapidly adjust to changing market conditions.

The cyclical nature explains why some experts have taken profits during recent highs, with one analyst noting they “sold MU last summer” due to these predictable industry patterns. Another pointed to disappointing memory chip earnings from ASML as a trigger to sell, highlighting how interconnected the semiconductor ecosystem truly is.

Micron’s AI-Driven Opportunity

Now for the part that has me truly excited! The artificial intelligence revolution is creating unprecedented demand for high-performance memory solutions. This isn’t just incremental growth—it’s potentially a paradigm shift in how much memory computing systems require.

Modern AI models require:

– Massive amounts of high-bandwidth memory

– Faster data access speeds

– More storage capacity

– Energy-efficient memory solutions

Micron is positioned to capitalize on all these needs. As data centers continue expanding to support AI workloads, the demand for Micron’s products—particularly their high-bandwidth memory solutions—is expected to grow substantially.

One analyst highlighted that Micron has a “clear runway” ahead, specifically because of how the AI revolution has created an enormous appetite for their products. Another noted that while memory tends to be volatile on the chip side, there’s “more memory being built into data centers,” creating a sustained demand driver.

Micron – Financial Outlook and Growth Projections

What really catches my attention about Micron’s story is the projected earnings growth for 2025. Several analysts are forecasting substantial earnings improvements in the coming year, which could be a catalyst for significant stock price appreciation.

The current valuation metrics suggest Micron may be attractively priced relative to these future growth prospects. This creates that magical scenario investors love: a quality company temporarily trading at a discount to its intrinsic value.

However, we must acknowledge that forecasting earnings in the semiconductor industry can be notoriously difficult due to:

– Rapid technological changes

– Competitive pressures

– Macroeconomic factors affecting enterprise and consumer spending

– Supply chain constraints

Investment Strategy Considerations

Given what we’ve learned about Micron’s position and industry dynamics, let’s consider some strategic approaches for investors:

For Long-Term Investors – Micron

If you believe in the secular growth story of AI and increased memory requirements, Micron represents an opportunity to invest in a critical component supplier. However, you must be prepared for significant volatility and potentially extended periods of underperformance during industry downturns.

As one analyst emphasized, “patience” is critically important when investing in memory chip companies. The long-term trajectory looks promising, but the path won’t be straight up.

For Tactical Traders – Micron

Understanding the memory chip cycle can create opportunities for more active trading strategies. Buying during periods of industry pessimism and taking profits during periods of optimism has historically worked well in this sector.

The statement that Micron is “a trade, not an investment” speaks to this approach. Some traders specifically look for signs of the memory cycle bottoming before establishing positions.

For Cautious Investors

If volatility concerns you, consider establishing a smaller position than you might normally take and prepare to average in over time. Alternatively, using options strategies to generate income or provide downside protection could be appropriate given the stock’s characteristics.

Competitive Threats and Market Challenges

While the long-term outlook appears positive, we must acknowledge the challenges Micron faces:

-

International Competition: The report specifically mentioned China building out facilities for memory chips, creating additional supply that will influence cyclicality in the space.

-

Technological Disruption: New memory technologies could potentially leapfrog current solutions, though Micron invests heavily in R&D to stay ahead.

-

Market Concentration: A relatively small number of large customers can exert pricing pressure during negotiation cycles.

-

Geopolitical Risks: Semiconductor manufacturing has become increasingly politicized, creating potential regulatory and trade challenges.

The Bottom Line on Micron Technology

After analyzing the collective wisdom from numerous analysts, I believe Micron presents an intriguing opportunity for investors who understand its business dynamics and are willing to embrace (or even leverage) its cyclical nature.

The AI growth catalyst is substantial and likely sustainable, while the company’s financial prudence during previous downturns suggests management knows how to navigate the industry’s inherent volatility.

For those looking to add semiconductor exposure to their portfolios, Micron offers an alternative to the more richly-valued AI chip designers. With memory being an essential component of all computing systems—and increasingly important for AI applications—Micron sits at the intersection of necessity and innovation.

Remember that successful investing in cyclical industries often requires:

– A longer time horizon than you might initially expect

– Emotional discipline during drawdowns

– An understanding of industry-specific metrics

– The ability to distinguish between temporary setbacks and fundamental problems

I’m genuinely excited about Micron’s prospects in the coming years, but I also respect the wisdom of the analysts who emphasize the importance of timing and patience when investing in this fascinating but challenging corner of the technology sector.

What are your thoughts on Micron Technology? Are you bullish on memory chip makers as AI adoption accelerates, or do you have concerns about the cyclical risks? I’d love to hear your perspective!